Have you ever thought about how many more years you have to work? For someone in their mid-20s, you could have a long way to go considering the official retirement age is 65.

Have you ever thought about how many more years you have to work? For someone in their mid-20s, you could have a long way to go considering the official retirement age is 65.

That’s forty more years of working in a job you may not love, or forty more years of being obligated to show up to some office, Monday through Friday, and spend all day doing tasks that you don’t find meaningful or fulfilling.

Sounds kind of miserable when you look at it that way. But, thankfully, your life doesn’t have to look like this.

What If You Could Retire in 20 Years – or Less?

The reason most 20-somethings can expect to work until at least 65 (and possibly much longer) is because they either don’t save and invest for their future, or they don’t save enough.

Traditional financial wisdom tells you to invest about 10 percent of your salary. If you do this from the time you enter the workforce until you’re 65, you’ll likely have enough money to retire at that point.

But that’s the problem with saving such a small percent of your income: it takes a long time to build up enough assets in your investment portfolio to actually make earning a paycheck optional, and allow you to retire.

You could easily retire in 20 years or sometime in your 40s if you simply save and invest greater percentages of what you earn. In fact, the math behind early retirement is pretty simple. The gist of it? The more you invest right now, the faster you can get to a place where work is optional.

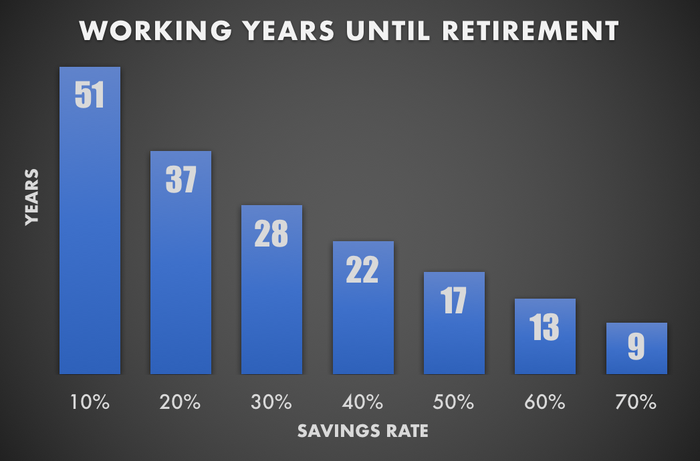

Specifically, to retire in 20 years, you need to invest between 40 and 50 percent of your income:

Source: The Motley Fool

Want to retire even sooner? Then save a larger percentage of your income. You could retire in just 9 years from now if you committed to putting 70 percent of your income into your investment accounts and retirement plans. Of course, that’s not feasible for a majority of us and be able to survive financially now. But it’s a great starting point of discussion.

How to Save a Bigger Percentage of What You Earn

The way to retire in 20 years or less is pretty simple to understand: set aside larger portions of your income and invest it. But most people can’t or won’t take 10 percent of their paycheck and allocate it to their 401(k), IRA, or another investment vehicle to earmark it for the future.

Saving and investing more does require you to cut back on your spending today. You have to prioritize some delayed gratification.

You can do this by:

- Downsizing your biggest fixed expenses (look for lower-cost rent or take on roommates, for example).

- Creating a budget and tracking your spending (and also eliminated the fat from that budget and being more mindful about how you use your money).

- Looking for ways to save on what you need to buy.

But even if you live more frugally than you do now and look to cut expenses in a reasonable way (that doesn’t leave you feeling extremely deprived), you need more than just discipline and willpower to say no to little things today so you can get to something bigger in the future.

You need a strong income to be able to afford even most modest living expenses and bank 40 to 50 percent of what you earn. In addition to cutting back on discretionary expenses, you need to strategically boost your income to retire in 20 years or less.

That could include doing things like:

- Learning new skills so you can demand more pay.

- Taking on more responsibility so you can better negotiate for a raise at your current job.

- Changing positions and negotiating a higher starting salary at a new job.

- Starting your own business (or at least, a side hustle).

Invest Wisely

Just sticking your retirement savings in a low -cost index fund maybe the simplest and least expensive approach but may not always be your best option. How your funds are invested are just as important, if not more important than the amount of funds you are setting aside.

Finding the right balance between being too conservative and not having enough to retire, or being too aggressive, and a market correction giving you the same result, not having enough funds to retire, can be tricky.

A prudent approach is to work with a fee-based investment advisor who can help ensure your investment approach is properly linked to your financial goals.

It’s Not Retirement, It’s Financial Freedom

Of course, the idea of retiring — even if it is within 20 years instead of 40 or more — might not appeal to you at all. The traditional definition of “retiring” literally means retreating from work… and often, a complete lack of work leaves people even more unhappy than holding a job they don’t love.

Work gives life purpose and meaning, so to quit it entirely might not appeal to you. If that’s the case, don’t think about this as “how to retire in 20 years.” Instead, reframe it as “how to be financially independent in 20 years or less.”

In other words, by following this strategy, you make working something that becomes optional – and that means you have more freedom and choice over what you do for work because you won’t be bound to a particular paycheck.

You can spend your time exploring your interests and your passions. You might even want to take on work that’s really meaningful to you but isn’t realistic now because it doesn’t pay enough.

When you’re free from the obligation to earn a certain income, you get more say in what you actually do with your time.

It’s not just about retiring, or quitting work and sitting around doing nothing. It’s about the fact that money can provide freedom, choice, and flexibility — and you can access total financial freedom in 20 years or less if you simply commit to investing more of your income.

You must be logged in to post a comment.