Retirees who are entitled to a government pension can have an unpleasant surprise waiting for them when they apply for their Social Security benefits. Two different Social Security provisions for retired government workers—the Government Pension Offset and the Windfall Elimination Provision—can reduce the amount of your Social Security benefit checks.

If you are eligible for a government pension, it’s important that you understand just how your pension can affect any Social Security benefits you may receive. Here’s what you need to know:

The Government Pension Offset Reduces Spousal and Survivor Benefits

If you receive a government retirement pension after a career in federal, state, or local government, then you are not eligible for Social Security retirement benefits, since you did not pay into the Social Security system. However, if you are married to a worker who is eligible for Social Security retirement benefits, then the situation gets a little more complicated.

As the spouse of a Social Security beneficiary, you are entitled to a spousal (or survivor) benefit based upon your spouse’s work record. If Social Security were to give you a full spousal benefit, you would receive both your full government pension, as well as a spousal benefit that is calculated as if you did not work at all—which would be an unfair increase for couples that include one Social Security beneficiary and one government pensioner. In couples where both spouses are eligible for Social Security retirement benefits based on their own records, spousal benefits are offset (and often eliminated entirely) by each spouse’s own retirement benefits.

In order to fairly calculate the spousal and survivor benefits of government employees who did not pay Social Security taxes, the Social Security Administration employs the Government Pension Offset. This provision reduces a government pensioner’s spousal benefits by two-thirds of his or her government pension.

For instance, Antonio receives a monthly civil service pension of $600. His wife Ione, worked in the private sector and receives Social Security benefits based upon her work record. Because of Ione’s Social Security work record, Antonio is eligible for a spousal benefit of $500 per month. But Antonio’s spousal benefit is offset by two-thirds of his pension, or $400, which is deducted from the Social Security spousal benefit. This means he only receives $100 per month in Social Security spousal benefits.

The Government Pension Offset can potentially eliminate your entire spousal or survivor benefit. If Antonio’s monthly civil service pension were $1,200, and he were still eligible for a spousal benefit of $500, he would receive no Social Security spousal benefit at all. That’s because two-thirds of his government pension–$1,000—is more than he is eligible to receive as a spousal benefit.

The Windfall Elimination Provision Reduces Your Retirement Benefits

There are many individuals who are eligible for both a government pension and Social Security retirement benefits based upon their own work record. These workers may have spent a large chunk of their career in civil service—for which they will receive a government pension—but they also have enough work experience in a position for which they paid Social Security taxes that they are also eligible for Social Security retirement benefits.

Since Social Security retirement benefits are progressive, lower-income beneficiaries receive a higher percentage of their pre-retirement income than do higher-income beneficiaries. This progressive calculation of benefits could be unfairly generous to beneficiaries who have both a long, non-covered work history, as well as a shorter, Social Security-eligible, covered work history.

To rectify this potential unfairness, Social Security uses the Windfall Elimination Provision, which reduces Social Security benefits for such beneficiaries, on the assumption that they are also receiving a government pension.

Windfall Elimination Provision Reduction Factor

To understand how much the Windfall Elimination Provision will affect your benefits, you first need to understand how the Social Security Administration determines your monthly benefit. It starts with your primary insurance amount (PIA), which is the amount of money you are entitled to as a retirement benefit when you reach your full retirement age.

Social Security calculates PIA by adding together 90 percent of the first $895 of your average monthly earnings, plus 32 percent of your average monthly earnings between $895 and $5,397, plus 15 percent of your average monthly earnings above $5,397.

If you are eligible for a government pension, then Social Security will reduce the 90 percent factor in the PIA formula based on how long you worked in non-Social Security eligible employment. The Social Security Administration looks at the number of years you had “substantial earnings” for which you paid Social Security taxes, and adjusts the 90 percent factor down based upon those years.

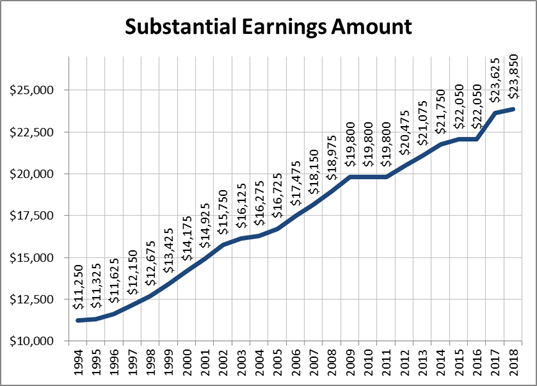

How much money qualifies as substantial earnings? The amount changes each year:

If you have had 30 or more years of substantial earnings, then Social Security does not reduce your benefits. If you have less than 30 years of substantial earnings (and you are also eligible for a government pension), then your PIA will be calculated using a reduced factor:

|

Years of Substantial Earnings |

Percentage of first $895 monthly |

|

30 or more |

90% |

|

29 |

85% |

|

28 |

80% |

|

27 |

75% |

|

26 |

70% |

|

25 |

65% |

|

24 |

60% |

|

23 |

55% |

|

22 |

50% |

|

21 |

45% |

| 20 or less |

40% |

The Social Security Administration offers two calculators to help you determine how the Windfall Elimination Provision can affect your benefits. The simple calculator will give you a ballpark estimate, while the detailed calculator can help you get a more accurate estimate.

Don’t Forget to Factor These Provisions Into Your Retirement Plans

Don’t let yourself get caught short by a smaller-than-expected Social Security benefit. If you are eligible for a government pension, make sure you account for Social Security’s Government Pension Offset and Windfall Elimination Provision when you calculate your retirement income.

PLEASE NOTE: The information being provided is strictly as a courtesy. When you link to any of these web-sites provided here, you are leaving this site. Our company makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information and programs made available through this site.

This information is not intended to be legal or tax advice. The author can provide information, but not advice related to social security benefits. Clients should seek guidance from the Social Security Administration regarding their particular situation. Social Security benefit payout rates can and will change at the sole discretion of the Social Security Administration. For more information, please consult a local Social Security Administration office, or visit www.ssa.gov.

You must be logged in to post a comment.